September 01, 2017, 11:54 AM

41

Frank Holmes made the call:

Got a Bully Problem? Send in a Tough GuyAugust 30, 2017

Here’s a news flash for you: Donald Trump is controversial and caustic. He says exactly what’s on his mind, no matter how incendiary, and he’s not afraid to make enemies, even with members of his party. “Bully” is a phrase many people use to describe the 45th U.S. president.

The thing is, no one who voted for Trump—I think it’s safe to say—didn’t already know this about him. His being a bully is baked right into his DNA, and he expertly honed this persona during his stint as the tough-as-nails host of NBC’s The Apprentice.

Remember when Trump received flak a few weeks back for retweeting a gif of himself body-slamming “CNN”? The clip actually came from WrestleMania 23 in 2007, when the future president defeated World Wrestling Entertainment (WWE) CEO Vince McMahon—and consequently got to shave his head—in a fight billed as the “Battle of the Billionaires.” Trump’s bombastic style and rough edges were so aligned with the smack-talking world of professional wrestling that he was inducted into the WWE Hall of Fame in 2013.

That’s who Trump is. He’s a tough guy. But I’m convinced that’s why he was elected—to stand up to even bigger bullies.

Standing Up to the Beltway Party

Right now those bullies include members of the beltway party, sometimes referred to as “the deep state”—career bureaucrats, lobbyists, regulators and other officials who make it their mission to oppose any Washington outsider who threatens to shake up the status quo.

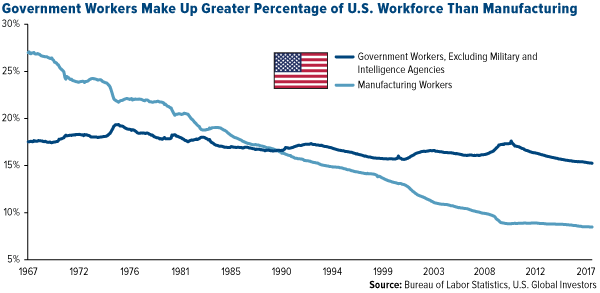

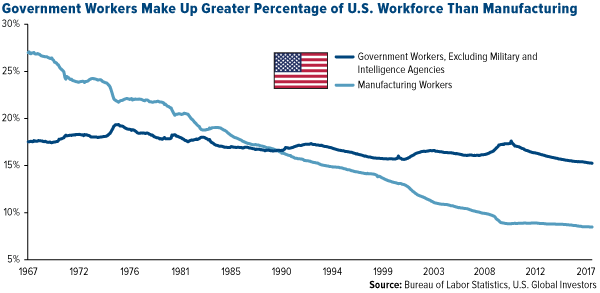

The beltway party isn’t a new phenomenon, of course. For the past 50 years, the number of government workers relative to the entire U.S. workforce has remained virtually the same. Meanwhile, the percentage of Americans employed in manufacturing has steadily plummeted.

Government workers make up greater percentage of U.S. workforce than manufacturing

Think about it: We have fewer people in this country who innovate and build things than people who enforce the laws that often prevent manufacturers from innovating and building at their fullest potential. What hope do they have?

When you have a bully problem, you don’t send in a Boy Scout. That’s what we learned with Jimmy Carter, whose presidency Trump’s administration so far resembles in an interesting way, according to former Federal Reserve chair Ben Bernanke. Carter and Trump, both outsiders, were sent to Washington to “drain the swamp” of the beltway party. We all know unsuccessful Carter was, but that’s likely because he was simply too nice and “decent” for the White House.

I don’t think anyone would ever accuse President Trump of being too nice and decent, but I also don’t think decency is what we need right now. Decency won’t motivate Congress to pass tax reform. Decency won’t roll back strangulating regulations.

Unlike Carter, Trump is a disruptor. He’s disrupting government just as Sam Walton, Jeff Bezos and Elon Musk disrupted the marketplace with Walmart, Amazon and Tesla. These entrepreneurs and businesses were initially criticized for shaking up the status quo and setting new precedents. Similarly, Trump gets harshly maligned, and for the very same reasons.

A Battle Brewing over Financial Regulations to EPA Finding Ways to Stop Infrastructure Spending

Most everyone is aware of the fight that took place this past weekend between now-retired Floyd Mayweather and UFC Lightweight Champion Conor McGregor. Although official pay-per-view data hasn’t been released yet, the number of people who paid the $100 to tune in is expected to exceed the roughly 4.6 million who bought access to watch the Mayweather-Manny Pacquiao fight in 2015. This year, Mayweather’s purse was a guaranteed $100 million but will likely be northwards of $200 million. When all is said and done, McGregor’s payday is estimated to be about half that, according to ESPN.

It wasn’t called “the Money Fight” for nothing.

But over the weekend, a “money fight” of a different kind took place, with the first volley fired in Jackson Hole, Wyoming, where the annual economic symposium of central bankers was held. In what could be her last speech as chair of the Federal Reserve, Janet Yellen defended the efficacy of financial regulations that were enacted following the subprime mortgage crisis nearly 10 years ago.

Because of the reforms, Yellen said, “credit is available on goods terms, and lending has advanced broadly in line with economic activity in recent years, contributing to today’s strong economy.” Banks are “safer” today, she insisted.

Never mind that her conclusions here are questionable at best. Post-crisis reforms such as 2010’s Dodd-Frank Act have actually led to a large number of community banks drying up, giving borrowers, especially in rural areas, fewer options. Because of added compliance costs, many banks have done away with free checking, which disproportionately affects lower-income customers.

Leaving all that aside for now, Yellen’s intent was crystal clear. She made it known to President Trump that, should he re-nominate her to head the Fed when her term ends in February, she will do what she can to protect post-crisis regulations.

Trump, of course, has another point of view. He’s promised to do a “big number” on Dodd-Frank, which he claims has prevented “business friends” from getting loans.

So far he’s been true to his word. In April, he signed an executive order issuing a review of Dodd-Frank. Many of his top-level appointments to the Federal Deposit Insurance Corporation (FDIC), the U.S. Securities and Exchange Commission (SEC) and other such federal agencies have come from a pool of people the big banks feel comfortable with. And his Cabinet is well-stocked with former investment bankers, most notably Steven Mnuchin, who heads the Treasury Department.

In June, the Treasury Department released its recommendations for regulatory reform. Among them are a wholesale reduction in financial regulations, a decrease in their complexity and greater coordination among regulators.

But there’s only so much the executive branch can do alone. A bill designed to repeal key provisions in Dodd-Frank easily passed the House in June and is now in the Senate’s hands. Because it will need to clear a 60-vote threshold, a clean repeal bill looks unlikely, but relief of any kind is better than none.

Abrasive as his style may be, Trump is our greatest hope right now in bringing sensible reform to our complex tax code and regulatory infrastructure.

Looking Ahead to 2020

The Democrats might very well take a page out of the Republicans’ handbook and put up a similarly confrontational, in-your-face candidate in 2020. Right now I can think of no one more fitting of that description than Massachusetts senator Elizabeth Warren. A Democratic Socialist cut from the same cloth as Bernie Sanders, Sen. Warren can be every bit as much a bully as Trump. If you’ve seen her grill someone during a Congressional hearing, you’ll know what I’m talking about.

But whereas Trump supports free markets and business-friendly policies, I believe a President Warren would usher in a new age of punitive taxes and regulations on steroids. Instead, businesses need blue dog Democrats, those with a more conservative voting record, who better understand the need for free markets and a healthy economy.

As I’ve often said, it not the politics that matter so much as the policies. I support the candidate who makes it easier for Americans to conduct business and create capital. Sen. Warren has many admirable qualities, I’m sure, but her socialist, far-left ideology would be devastating to businesses and investors alike.

http://www.usfunds.com/investo...-bully/#.WamO-saQyY0September 01, 2017, 08:15 PM

clipper1If you are willing to read all of this you will have gained some serious education. Yes it is long, but....the 4 bullet points at the end for those of you that don't like to read..

https://theconservativetreehou...terests/#more-138031EPIC Battle – NAFTA Round Two Begins in Mexico – U.S. Based Multinational Corporations Fight to Defend Their Interests…

Posted on September 1, 2017 by sundance

No current events have as much impact on the lives of ordinary paycheck-to-paycheck Americans as the NAFTA trade negotiations. Every person in the U.S., our children and the lives of following generations, are impacted by the ongoing economic battle. The consequences are epic in proportion, yet the MSM insufferably avoids discussion.

Against the backdrop of NAFTA Round #2 renegotiations beginning in Mexico, the massive Multinational Corporations fight back to retain their market exploitation. Decades-long established masks are dropping; the grand usurpation’s are being exposed; there are trillions of dollars at stake.

MEXICO CITY (Reuters) – Trade negotiators from Canada and the United States gathered under rainy skies in Mexico City on Friday to discuss the North American Free Trade Agreement, with the mood darkened by U.S. President Donald Trump’s persistent threats to pull out.

Teams from the three countries were due to kick off a second round of talks on 25 areas of discussion, with subjects such as digital commerce and small businesses seen as areas where consensus was possible, Mexican officials said.

The Sept. 1-5 round will also touch on more thorny topics such as rules governing local content in products made in North America, Mexico’s economy ministry said in a statement. Mexican officials believe Trump wants to include rules that some content must be made in the United States.

Trump’s attacks on NAFTA are seen by Mexican and Canadian officials as a negotiating ploy to wring concessions, but they have heightened uncertainty over the accord. Away from the diplomatic noise, the Mexico round of talks is expected to help define the priorities of each nation rather than yield major advances.

Trump and Canadian Prime Minister Justin Trudeau spoke by telephone on Thursday and stressed they wanted to reach an agreement on NAFTA by the end of the year, the White House said. If they achieve that, it could set a record among the fastest multinational trade negotiation.

The goal is to get a deal before Mexico’s 2018 presidential campaign starts in earnest. Officials fear the campaign will politicize talks, with nationalist frontrunner Andres Manuel Lopez Obrador already recommending a tougher line from Mexico.

Nevertheless, one Mexican official noted that Trump’s threats had put pressure on his negotiators, forcing them to adopt tougher positions “than they would like,” while another official said they were ready to leave the table if needed. (link)

Big Agriculture is mounting a massive push-back against the possibility of losing their control over commodity market systems they have created. A consortium of lobbying groups are now in full-frontal attack against the possibility that U.S. President Trump and his trade team will destroy their grand endeavors.

The trade groups are trying to block USTR Robert Lighthizer from modifying NAFTA rules to grant small and seasonal U.S. farms, non corporate entities, the ability to file market dumping claims against U.S., Mexican and Canadian corporations.

MEXICO – […] Lighthizer, in NAFTA negotiating objectives published by his office, said he would seek a “separate domestic industry provision for perishable and seasonal products” in trade cases.

The retailers and food industry groups argued that American producers could be left open to retaliatory measures if more complaints were to be filed, for instance, against avocados, tomatoes and other produce imported from Mexico.

The letter was signed by large trade groups including the National Council of Chain Restaurants, National Restaurant Association, National Retail Federation, Retail Industry Leaders Association and the Fresh Produce Association of the Americas.

A separate letter was sent on Wednesday by 26 U.S. agriculture groups – addressing Ross, Lighthizer, Agriculture Secretary Sonny Perdue and Gary Cohn, the top White House economic adviser. It too urged American negotiators to abandon the fresh produce proposal because it risks damaging U.S. producers. (read more)

This effort by the BigAg multinational corporations is more evidence of our earlier explanations of how commodity markets have been fully usurped by massive interests. There are no longer free markets; the 2017 agricultural sector is a ‘controlled market’.

There are massive international corporate and financial interests who are inherently at risk from President Trump’s “America-First” economic and trade platform. Believe it or not, President Trump is up against an entire world economic establishment.

CTH will continue to outline how it works because when you understand how it works in the modern era you will understand why the agents within the system are so adamantly opposed to U.S. President Trump.

The biggest lie in modern economics, willingly spread and maintained by corporate media, is that a system of global markets still exists.

It doesn’t.

Every element of global economic trade is controlled and exploited by massive institutions, multinational banks and multinational corporations. Institutions like the World Trade Organization (WTO) and World Bank control trillions of dollars in economic activity. Underneath that economic activity there are people who hold the reigns of power over the outcomes. These individuals and groups are the stakeholders in direct opposition to principles of national economics.

The modern financial constructs of these entities have been established over the course of the past three decades. When you understand how they manipulate the economic system of individual nations you begin to understand understand why they are so fundamentally opposed to President Trump.

In the Western World, separate from communist control perspectives (ie. China), “Global markets” are a modern myth; nothing more than a talking point meant to keep people satiated with sound bites they might find familiar.

Global markets have been destroyed over the past three decades by multinational corporations who control the products formerly contained within ‘free and fair’ markets.

The same is true for “Commodities Markets”. The multinational trade and economic system, run by corporations and multinational banks, now controls the product outputs of independent nations. The free market economic system has been usurped by entities who create what is best described as ‘controlled markets’.

U.S. President Trump smartly understands what has taken place. Additionally he uses economic leverage as part of a broader national security policy; and to understand who opposes President Trump specifically because of the economic leverage he creates, it becomes important to understand the objectives of the global and financial elite who run and operate the institutions. The Big Club.

Understanding how trillions of trade dollars influence geopolitical policy we begin to understand the three-decade global financial construct they seek to protect.

That is, global financial exploitation of national markets. FOUR BASIC ELEMENTS:

♦Multinational corporations purchase controlling interests in various national outputs and industries of developed industrial western nations.

♦The Multinational Corporations making the purchases are underwritten by massive global financial institutions, multinational banks.

♦The Multinational Banks and the Multinational Corporations then utilize lobbying interests to manipulate the internal political policy of the targeted nation state(s).

♦With control over the targeted national industry or interest, the multinationals then leverage export of the national asset (exfiltration) through trade agreements structured to the benefit of lesser developed nation states – where they have previously established a proactive financial footprint.

Against the backdrop of President Trump confronting China, and against the backdrop of NAFTA being renegotiated, revisiting the economic influences within the import/export dynamic will help conceptualize the issues at the heart of the matter. There are a myriad of interests within each trade sector that make specific explanation very challenging; however, here’s the basic outline.

For three decades economic “globalism” has advanced, quickly. Everyone accepts this statement, yet few actually stop to ask who and what are behind this – and why?

Influential people with vested financial interests in the process have sold a narrative that global manufacturing, global sourcing, global markets, and global production was the inherent way of the future. The same voices claimed the American economy was consigned to become a “service-driven economy.”

What was always missed in these discussions is that advocates selling this global-economy message have a vested financial and ideological interest in convincing the information consumer it is all just a natural outcome of economic progress.

It’s not.

It’s not natural at all. It is a process that is entirely controlled, promoted and utilized by large conglomerates and massive financial corporations.

Again, I’ll try to retain the larger altitude perspective without falling into the traps of the esoteric weeds. I freely admit this is tough to explain and I may not be successful.

Bulletpoint #1: ♦ Multinational corporations purchase controlling interests in various national elements of developed industrial western nations.

This is perhaps the most challenging to understand. In essence, thanks specifically to the way the World Trade Organization (WTO) was established in 1995, national companies expanded their influence into multiple nations, across a myriad of industries and economic sectors (energy, agriculture, raw earth minerals, etc.). This is the basic underpinning of national companies becoming multinational corporations.

Think of these multinational corporations as global entities now powerful enough to reach into multiple nations -simultaneously- and purchase controlling interests in a single economic commodity.

A historic reference point might be the original multinational enterprise, energy via oil production. (Exxon, Mobil, BP, etc.)

However, in the modern global world, it’s not just oil; the resource and product procurement extends to virtually every possible commodity and industry. From the very visible (wheat/corn) to the obscure (small minerals, and even flowers).

Bulletpoint #2 ♦ The Multinational Corporations making the purchases are underwritten by massive global financial institutions, multinational banks.

During the past several decades national companies merged. The largest lemon producer company in Brazil, merges with the largest lemon company in Mexico, merges with the largest lemon company in Argentina, merges with the largest lemon company in the U.S., etc. etc. National companies, formerly of one nation, become “continental” companies with control over an entire continent of nations.

…. or it could be over several continents or even the entire world market of Lemon/Widget production. These are now multinational corporations. They hold interests in specific segments (this example lemons) across a broad variety of individual nations.

National laws on Monopoly building are not the same in all nations. But most are not as structured as the U.S.A or other more developed nations (with more laws). During the acquisition phase, when encountering a highly developed nation with monopoly laws, the process of an umbrella corporation might be needed to purchase the interests within a specific nation. The example of Monsanto applies here.

Bulletpoint #3 ♦The Multinational Banks and the Multinational Corporations then utilize lobbying interests to manipulate the internal political policy of the targeted nation state(s).

With control of the majority of actual lemons the multinational corporation now holds a different set of financial values than a local farmer or national market. This is why commodities exchanges are essentially dead. In the aggregate the mercantile exchange is no longer a free or supply-based market; it is now a controlled market exploited by mega-sized multinational corporations.

Instead of the traditional ‘supply/demand’ equation determining prices, the corporations look to see what nations can afford what prices. The supply of the controlled product is then distributed to the country according to their ability to afford the price. This is how the corporation maximizes it’s profits.

Back to the lemons. A corporation might hold the rights to the majority of the lemon production in Brazil, Argentina and California/Florida. The price the U.S. consumer pays for the lemons is directed by the amount of inventory (distribution) the controlling corporation allows in the U.S.

If the U.S. harvest is abundant, they will export the product to keep the U.S. consumer spending at peak or optimal price. A U.S. customer might pay $2 for a lemon, a Mexican customer might pay .50¢, and a Canadian $1.25.

The bottom line issue is the national supply (in this example ‘harvest/yield’) is not driving the national price because the supply is now controlled by massive multinational corporations.

The mistake people often make is calling this a “global commodity” process. In the modern era this “global commodity” phrase is particularly BS.

A true global commodity is a process of individual nations harvesting/creating a similar product and bringing that product to a global market. Individual nations each independently engaged in creating a similar product.

Under modern globalism this process no longer takes place. It’s a complete fraud. Currently, massive multinational corporations control the majority of product inside each nation and therefore control the entire global product market and price.

EXAMPLE: Part of the lobbying in the food industry is to advocate for the expansion of U.S. taxpayer benefits to underwrite the costs of the domestic food products they control. By lobbying DC these multinational corporations get congress and policy-makers to expand the basis of who can use EBT and SNAP benefits (state reimbursement rates).

Expanding the federal subsidy for food purchases is part of the corporate profit dynamic. With increased taxpayer subsidies, the food price controllers can charge more domestically and export more of the product internationally. Taxes, via subsidies, go into their profit margins. The corporations then use a portion of those profits in contributions to the politicians. It’s a circle of money.

In highly developed nations this multinational corporate process requires the corporation to purchase the domestic political process (as above) with individual nations allowing the exploitation in varying degrees. As such, the corporate lobbyists pay hundreds of millions to politicians for changes in policies and regulations; one sector, one product, or one industry at a time. These are specialized lobbyists.

EXAMPLE: The Committee on Foreign Investment in the United States (CFIUS)

CFIUS is an inter-agency committee authorized to review transactions that could result in control of a U.S. business by a foreign person (“covered transactions”), in order to determine the effect of such transactions on the national security of the United States.

CFIUS operates pursuant to section 721 of the Defense Production Act of 1950, as amended by the Foreign Investment and National Security Act of 2007 (FINSA) (section 721) and as implemented by Executive Order 11858, as amended, and regulations at 31 C.F.R. Part 800.

The CFIUS process has been the subject of significant reforms over the past several years. These include numerous improvements in internal CFIUS procedures, enactment of FINSA in July 2007, amendment of Executive Order 11858 in January 2008, revision of the CFIUS regulations in November 2008, and publication of guidance on CFIUS’s national security considerations in December 2008 (more)

Bulletpoint #4 ♦ With control over the targeted national industry or interest, the multinationals then leverage export of the national asset (exfiltration) through trade agreements structured to the benefit of lesser developed nation states – where they have previously established a proactive financial footprint.

The process of charging the U.S. consumer more for a product, that under normal national market conditions would cost less, is a process called exfiltration of wealth.

It is never discussed.

To control the market price some contracted product may even be secured and shipped with the intent to allow it to sit idle (or rot). It’s all about controlling the price and maximizing the profit equation. To gain the same $1 profit a widget multinational might have to sell 20 widgets in El-Salvador (.25¢ each), or two widgets in the U.S. ($2.50/each).

Think of the process like the historic reference of OPEC (Oil Producing Economic Countries). Only in the modern era massive corporations are playing the role of OPEC and it’s not oil being controlled, it’s almost everything.

Again, this is highlighted in the example of taxpayers subsidizing the food sector (EBT, SNAP etc.), the corporations can charge U.S. consumers more. Ex. more beef is exported, red meat prices remain high at the grocery store, but subsidized U.S. consumers can afford the high prices. Of course if you are not receiving food payment assistance (middle-class) you can’t eat the steaks because you can’t afford them. (Not accidentally, it’s the same scheme in the ObamaCare healthcare system)

Individual flower growers in Florida go out of business because they didn’t join the global market of flower growers (controlled market) by multinational corporate flower growers in Columbia and South America, who have an umbrella company registered in Mexico allowing virtually unrestricted access to the U.S. market under NAFTA.

Agriculturally, multinational corporate Monsanto says: ‘all your harvests are belong to us‘. Contract with us, or you lose because we can control the market price of your end product. Downside is that once you sign that contract, you agree to terms that are entirely created by the financial interests of the larger corporation; not your farm.

The multinational agriculture lobby is massive. We willingly feed the world as part of the system; but you as a grocery customer pay more per unit at the grocery store because domestic supply no longer determines domestic price.

Within the agriculture community the (feed-the-world) production export factor also drives the need for labor. Labor is a cost. The multinational corps have a vested interest in low labor costs. Ergo, open border policies. (ie. willingly purchased republicans not supporting border wall etc.).

This corrupt economic manipulation/exploitation applies over multiple sectors, and even in the sub-sector of an industry like steel. China/India purchases the raw material, ore, then sells the finished good back to the global market at a discount. Or it could be rubber, or concrete, or plastic, or frozen chicken parts etc.

The ‘America First’ Trump-Trade Doctrine upsets the entire construct of this multinational export/control dynamic. Team Trump focus exclusively on bilateral trade deals, with specific trade agreements targeted toward individual nations (not national corporations). ‘America-First’ is also specific policy at a granular product level looking out for the national interests of the United States, U.S. workers, U.S. companies and U.S. consumers.

Under President Trump’s Trade positions, balanced and fair trade with strong regulatory control over national assets, exfiltration of U.S. national wealth is essentially stopped.

This puts many current multinational corporations, globalists who previously took a stake-hold in the U.S. economy with intention to export the wealth, in a position of holding contracted interest of an asset they can no longer exploit.

Perhaps now we understand better how massive multi-billion multinational corporations and institutions are aligned against President Trump.

Teach everyone you know folks. Teach them all. If we lose these battles we will never have another opportunity to fight them again.