SIGforum

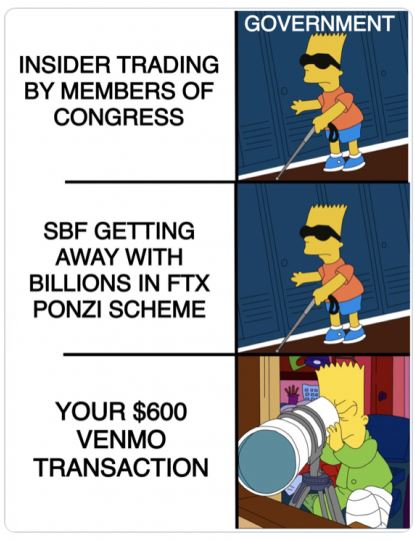

Lawmakers fight new Biden Regime rules that force Americans to fill out tax forms on all Venmo and PayPal transactions over $600

December 05, 2022, 01:21 PM

PASigLawmakers fight new Biden Regime rules that force Americans to fill out tax forms on all Venmo and PayPal transactions over $600

This is going to be an utter clusterfuck, the IRS can't keep up already as it is! Sure, they're going to ignore the creep that stole a BILLION dollars who's hiding out in the Bahamas but they'll go hard after the people selling old stuff out of their attics and garages? This is grotesque and will cause people to go to cash as they avoid all this nonsense:

The IRS coming for couches, TVs and wedding registries: Lawmakers put up a fight against Biden rules that force Americans to fill out tax forms on all Venmo and PayPal transactions over $600

December 05, 2022, 01:24 PM

RogueJSK

December 05, 2022, 01:26 PM

BigSwedeGuess what I won't be doing?

December 05, 2022, 01:44 PM

a1abdjI told the story on here awhile back. I was involved in a lawsuit involving a family business, and we had a forensic accountant digging into things.

We provided the IRS with a nice little case all wrapped up with a bow on top for what amounted to the IRS being owed in excess of $1,000,000. They wouldn't do anything about it. Not interested.

December 05, 2022, 02:52 PM

ZSMICHAELSorry I do not use Vennmo or Paypal and it certainly does appear to be a taxable transaction. There is a huge underground economy in the building trades where craftsman work off the books. I have gotten 1009 on amounts far less than 600 dollars.

As long as they are going after legit revenue I do not have an issue.

I wish lawmakers would go after the proposal to hire 187000 more IRS employees. That is a much larger concern.

December 05, 2022, 03:06 PM

KrazeehorseI lent my son some money and he is paying me back via Venmo. Monthly installments of $1000. So a simple thing may become a PITA. Gotta love gubmint involvement.

_____________________

Be careful what you tolerate. You are teaching people how to treat you.

December 05, 2022, 03:12 PM

ZSMICHAEL^^^^^^^^^

That should not be a problem. Just keep good records.

December 05, 2022, 03:13 PM

PASigLike the article comment section said, people use Venmo now to pay their rent. Are they going to start making people do 1099's on that now too? The IRS took almost a friggen' YEAR to get me my refund, how are they going to function now with millions more things to process?

This is all bullshit and the longer this SBF guy remains a free man, the more it pisses me off thinking about it.

December 05, 2022, 03:17 PM

ensigmaticEasy. Multiple transactions of less than $600.

I wonder if I'll get one of these? A buddy paid me back over $800 for materials I purchased on his behalf for a networking installation I did for him.

"America is at that awkward stage. It's too late to work within the system,,,, but too early to shoot the bastards." -- Claire Wolfe

"If we let things terrify us, life will not be worth living." -- Seneca the Younger, Roman Stoic philosopher December 05, 2022, 03:21 PM

DzozerI don't think it starts until 1/1/23

But I think that its not just the amount of the transaction, they are also tracking the number of transactions.

Also, its not just Venmo and PayPal - GunBroker and Ebay, along with sites like Reverb will be tracking transactions and sending a 1099.

'veritas non verba magistri' December 05, 2022, 03:31 PM

gearhoundsPeople will simply alter the way they do binness; instead of taking a $1000 for something, they’ll do three, three, and four hundred. Cash will be king in person. Money orders by mail for long distance stuff, and in amounts less than $600. Some will comply, some won’t have alternatives, but a lot will slip through the cracks.

Personally, I think the “bitcoin” crisis was all part of the plan to scare people away from a safe-ish way to transfer funds and destroy faith in an already sketchy way of doing business. DemocRATs clean up with a huge “donation” (bet the IRS won’t be after them…) and lots of people go broke. The head douchebag in the Bahamas will either evade justice or have a nice, keep-the-old-mouth-shut accident.

“Remember to get vaccinated or a vaccinated person might get sick from a virus they got vaccinated against because you’re not vaccinated.” - author unknown December 05, 2022, 03:38 PM

ZSMICHAELquote:

But I think that its not just the amount of the transaction, they are also tracking the number of transactions.

^^^^^^^^^^^^^^

My understanding a 1099 will be sent at years end if it is above 600 dollars. That is what I have do with my independent contractors.

December 05, 2022, 03:50 PM

HRKquote:

Originally posted by ensigmatic:

Easy. Multiple transactions of less than $600.

Won't work, total volume of $600, such as 12 $50 transactions through Venmo, Paypal, Zelle, will create one 1099 for payments received by you.

quote:

I wonder if I'll get one of these? A buddy paid me back over $800 for materials I purchased on his behalf for a networking installation I did for him.

Under the new bill, yes, and in order to disqualify it as income you'll need to show where you spent the $800 for him to offset the income.

Krazeehorse, same thing you'll need to be able to show records that the payments are re-payments not income.

I would tell him to send you a MO in the mail and why.

It's the younger generation that's driving this on one side, as well as Tech, they spend tons of money thinking up new ways to push database development and data aggregation for either compliance or sale.

December 05, 2022, 05:08 PM

BlackmoreThis all started with the March '21 "Covid Relief" bill (effective 1.1.22) and now it seems it has been expanded.

Since then I've ditched PayPal for selling stuff and kept careful track of eBay sales so as not to exceed $600 gross. I specifically asked if the sales tax they collect from buyers that I never see but am charged fees on was included in the gross. Was told "no" on the phone. Surprise, surprise, surprise. Apparently it is and I was either lied to or the person on the phone didn't know $#!t.

My last eBay transaction pushed me over the $600 point (according to them) and they demanded my SSN to get my money. No way. I canceled the deal and sent the buyer the item for nothing.

Foke eBay, Biden, Democrats, etc.

Rant off.

Harshest Dream, Reality

December 05, 2022, 05:26 PM

Opus Deiquote:

Originally posted by HRK:

quote:

Originally posted by ensigmatic:

Easy. Multiple transactions of less than $600.

Won't work, total volume of $600, such as 12 $50 transactions through Venmo, Paypal, Zelle, will create one 1099 for payments received by you.

On top of that it would probably be considered a structured transaction in some cases.

December 05, 2022, 05:30 PM

egregorequote:

This is going to be an utter clusterfuck, the IRS can't keep up already as it is!

Well, that's what the 87,000 extra agents are for, so …

December 05, 2022, 06:25 PM

VeeperWait so if I buy a couch for $1000, with money they’ve taxed as I earn it, and pay sales tax on said couch; when I sell the couch for $601 or more, the government thinks they’re entitled to some of that money?

They can fuck right off.

“The urge to save humanity is almost always only a false-face for the urge to rule it.”—H.L. Mencken December 05, 2022, 06:46 PM

ZSMICHAELI can see a lot of you guys will need CPA advice. Emotions aside this legislation was passed in the Spring. Of course this will drive people back to cash transactions.

December 05, 2022, 06:51 PM

Anushquote:

My understanding a 1099 will be sent at years end if it is above 600 dollars. That is what I have do with my independent contractors.

The 1099 is for a yearly total above $600.

Paypal F&F is not currently reported.

Zelle transactions are not currently reported.

The 1099 is to be reported on a Schedule C.

$600 - $1000 original cost is a loss of $400, but since it is a hobby the loss can not be taken on the tax return.

In 2020 IRS disposed of 30 million 1099's without entering them in the system.

https://www.journalofaccountan...rmation-returns.htmlMost taxpayers think a 1099 is the same as a W2.

__________________________________________________

If you can't dazzle them with brilliance, baffle them with bullshit!

Sigs Owned - A Bunch

December 05, 2022, 06:57 PM

RightwireOnce he forces us all onto virtual currency they'll monitor and record 100% of all monetary transactions and assure proper taxes are applied.

Pronoun: His Royal Highness and benevolent Majesty of all he surveys

343 - Never Forget

Its better to be Pavlov's dog than Schrodinger's cat

There are three types of mistakes; Those you learn from, those you suffer from, and those you don't survive.